Match Each Type of Financing With Its Source

Borrowings from banks are an important source of finance to companies. As the name suggests VC firms provide expansion money for a newly profitable company.

To Ensure That You Don T Encounter Any Last Minute Issues On Your Home Buying Journey There Are Five Major Approval Road Bad Credit Mortgage Approval Debt

Short Term Source of Finance These are funds just required for a year.

. Level - 0 diagram c. Cash inflows in this category include cash receipts from issuing stock or bonds and from borrowing through long term loans. Bridge financingexit of venture capitalist.

There are 4 different types of analytics. Provides automatic payment services provides online banking accepts tax return refunds. Companies use retained earnings from business operations to expand or distribute dividends to their shareholders.

Credit cardscan be used to borrow money topurchase a housecan be swiped at stores to makeimmediate purchases on creditmortgage loanspersonal loanscan be used to obtain the funds tobuy a vehicleauto loanscan be used to borrow a lump sum ofmoney for an individual to use. Are a few examples of these sources. Here we start with the simplest one and go further to the more sophisticated types.

Oldest form of media-newspapers and magazines the most open to new participants such. The bank will usually require that the start. For homebuyers there are five basic types of mortgage loan options.

The main sources of funding are retained earnings debt capital and equity capital. Sources Of Financing Business. Match each type of media source to its relevant characteristics.

Types of data analytics. The VC firm then exits by selling off its shareholdings of the company. Match each type of loan with the way it is most commonly used.

Match each type of financing with its source. Loans usually for more than 1 to 180 days of period is known as short-term types of finance. No comments for Match Each Type of Financing With Its Source Post a Comment.

Khadija Khartit is a strategy investment and funding expert and an educator of fintech and strategic finance in top universities. Funding from personal savings is the most common type of funding for small businesses. The source includes borrowings from a public deposit commercial banks commercial paper loans from a financial institute and lease financing etc.

Medicaid represents 1 out of every 6 spent on health care in the US and is the major source of financing for states to provide coverage to meet the health and long-term needs of their low-income. Statement of Cash Flows The Statement of Cash Flows also referred to as the cash flow statement is one of. You can consider debt financing as being divided into three types of finance they are.

Personal Investment or Personal Savings. Matching is a cash flow immunization strategy used to safeguard the funding of future liabilities when due. 20 21 Data cannot move directly to an outside sink from a data store.

Conventional jumbo government fixed-rate and adjustable-rate. Popular Total Pageviews Powered by Blogger Labels 2nd a Anti Brand Car Each Fda Financing Hand Is Logo Longitude Many of Puerto Smoking Source the to Tv wallpaper With Words X Report Abuse About Me Bio_Kiley73 View my complete profile Archive. Short-term finance medium-term finance and long-term finance.

Bank lending is still mainly short term although medium- term lending is quite common these days. Here is what to know about each. Financing cash flow comes from conducting financing activities for the business.

Match each of the following terms with its description. While I have identified 41 sources of funding for your business below are the 5 most common. As it happens the more complex an analysis is the more value it brings.

Financing Cash Flow. This are made to cover occasional or temporary requirements and shortage of funds. Building society trust company asset management firm stock brokerage firm.

2 the Balance Sheet. Match the service providers to the functions performed by them. The two issues with this type of funding are 1 how much personal savings you have and 2 how much personal savings are you willing to risk.

The financial statements are key to both financial modeling and accounting. Funding from Personal Savings. Balance Sheet The balance sheet is one of the three fundamental financial statements.

Loans from Commercial Banks. Best Common Sources of Financing Your Business or Startup are. A bank loan provides a longer-term kind of finance for a start-up with the bank stating the fixed period over which the loan is provided eg.

5 years the rate of interest and the timing and amount of repayments. Loan capital This can take several forms but the most common are a bank loan or bank overdraft. And 3 the Cash Flow Statement.

Short-Term Types of Finance. Or sourcessinks to a common location. Finally the company is expected to either go public or be bought by a third-party company.

Commercial Bank Loans and Overdraft. She has been an investor entrepreneur and advisor for more. Descriptive analytics answers the question of what happened.

The goal is to obtain fixed. Businesses raise funds by borrowing debt privately from a bank or by going public issuing debt securities. Bank lending is still mainly short term although medium- term lending is quite common these days.

Match each type of financial institutional with its correct description. In other words financing cash flow includes obtaining or repaying capital be it equity or long term debt. Working Capital Loans from Commercial bank and trade credit etc.

The type of loan required and available interest rates.

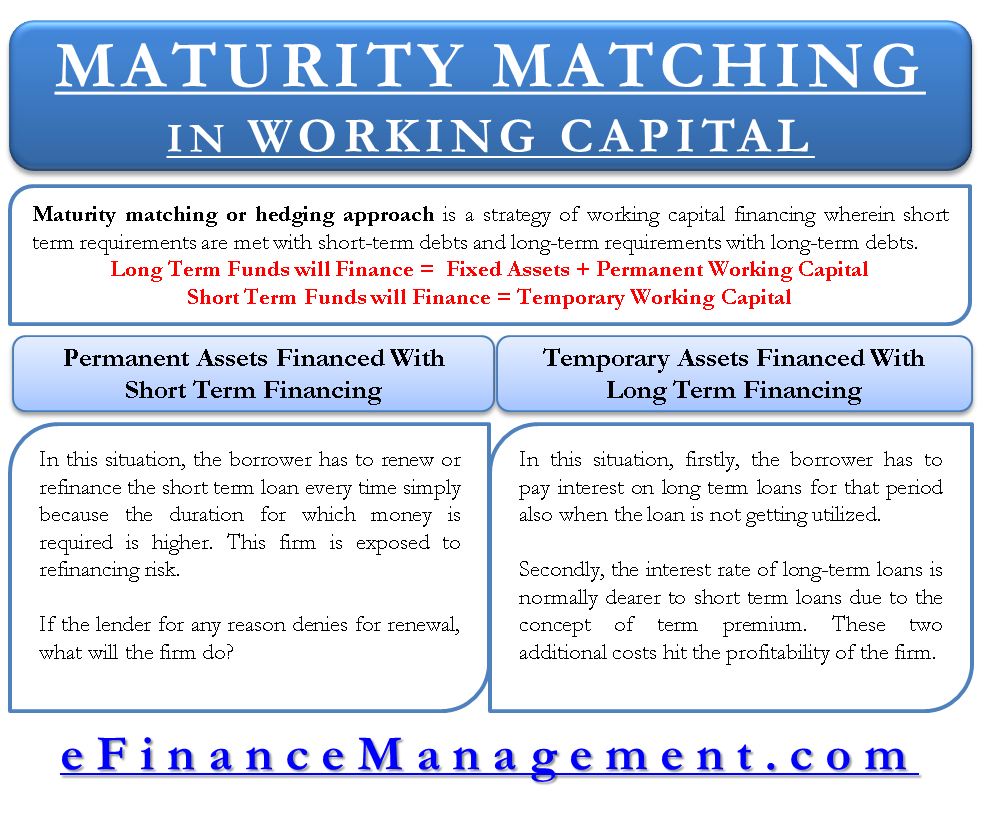

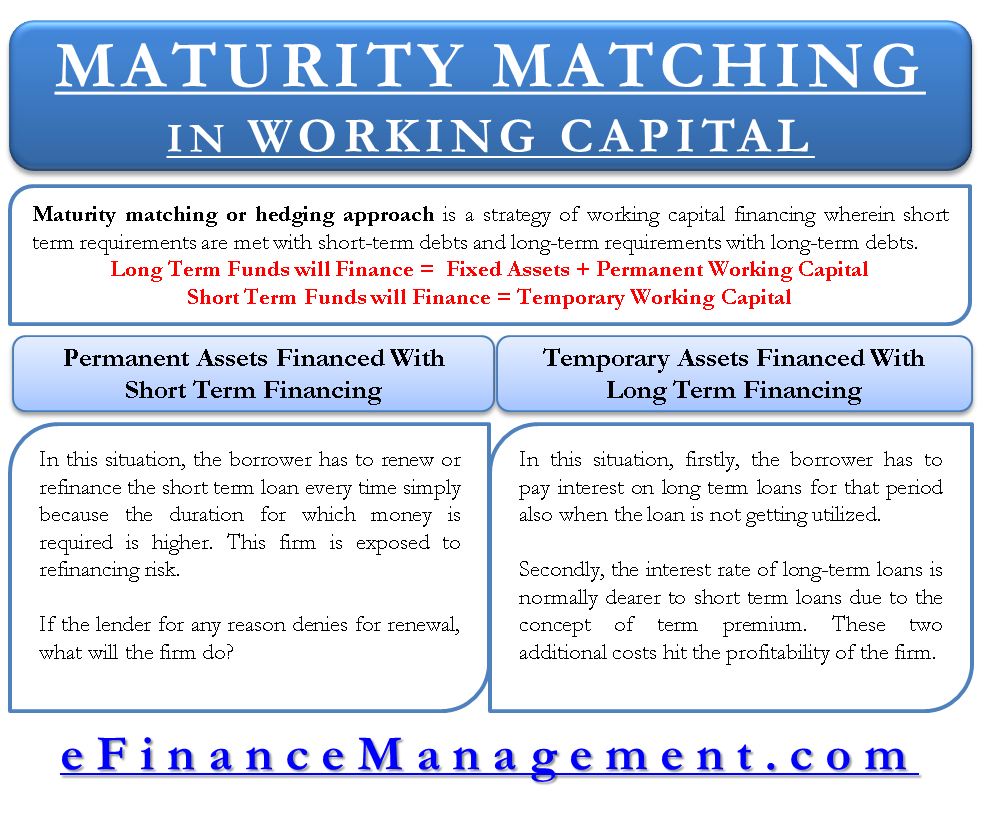

Financing Strategies Financial Management Financial Analysis Website Development Process

Maturity Matching Or Hedging Approach Rationale Pros Cons Example

:max_bytes(150000):strip_icc()/dotdash_INV_final-Portfolio-Immunization-vs.-Cash-Flow-Matching-Whats-the-Difference_Jan_2020-02-e2d9bcf68c16437d893a766a5656002a.jpg)

No comments for "Match Each Type of Financing With Its Source"

Post a Comment